New Zealand’s manufacturing sector saw another, albeit slight, improvement in its level of expansion, according to the latest BNZ – BusinessNZ Performance of Manufacturing Index (PMI).

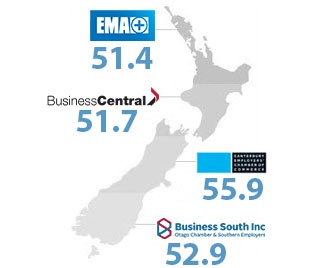

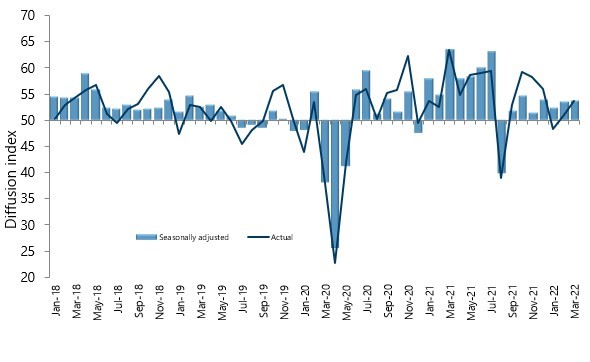

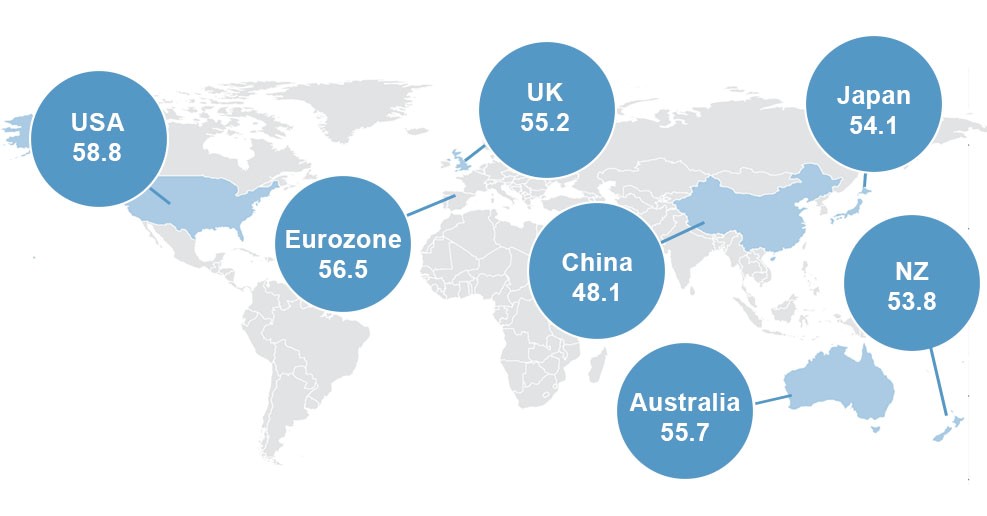

The seasonally adjusted PMI for March was 53.8 (a PMI reading above 50.0 indicates that manufacturing is generally expanding; below 50.0 that it is declining). This was 0.2 points higher than February, and above the long-term average of 53.1 for the survey.

BusinessNZ’s Director, Advocacy Catherine Beard said that the March result was another encouraging step towards getting the sector back on track.

“In terms of the main sub-indices, New Orders (61.0) continued its healthy momentum upwards, although Production (50.9) did fall back to its level of expansion experienced in January. Employment (52.4) rose to its highest level since September 2021, while Finished Stocks (53.5) also picked up to its highest result since October 2021.”

Comments from manufacturers were still firmly in negative territory (64.2%), although down from 69.9% in February. Unsurprisingly, COVID dominates discussion, with supply chain disruptions one of the key outcomes.

BNZ Senior Economist, Doug Steel stated that “Omicron’s impact may not be as harsh as the first 2020 COVID lockdown or last year’s Delta lockdown, but it’s there. Production has struggled, with the index slipping to 50.9 in March and a bit further below its long-term average.”