The recent Christchurch earthquake has led to a clear divide in the level of activity between the two main islands, according to the BNZ – BusinessNZ Performance of Services Index (PSI).

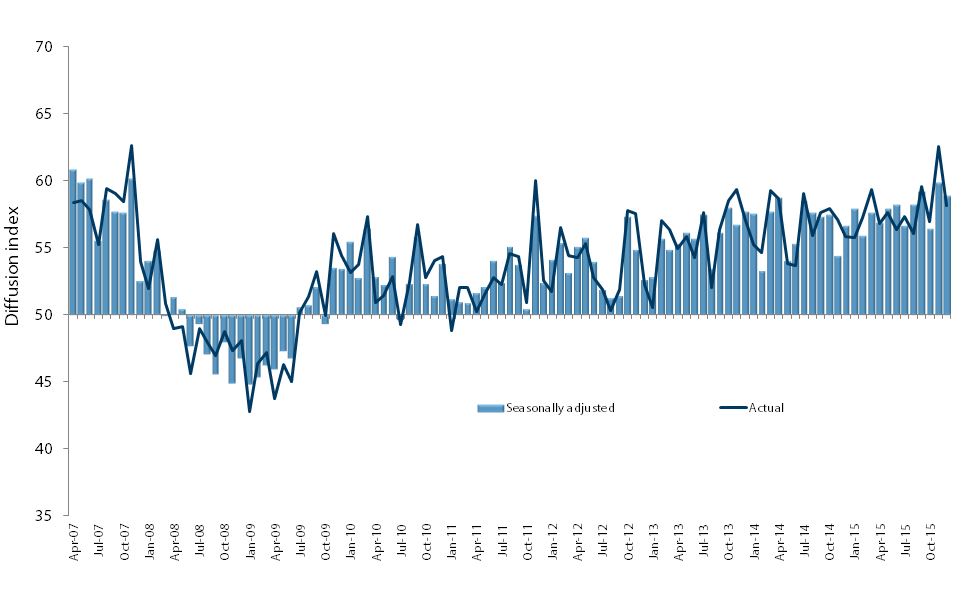

The PSI for March was 50.8. This was down 0.2 points from February, and the same as the January 2011 result. A PSI reading above 50.0 indicates that the service sector is generally expanding; below 50.0 that it is declining. The average PSI value for 2009 was 48.8, while for 2010 it was 53.2.

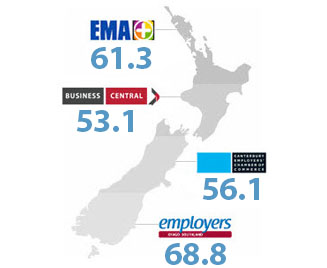

BusinessNZ chief executive Phil O’Reilly said that like its sister survey the PMI, the PSI also showed a clear distinction in activity levels between the North and South Islands.

“While the significant drop in activity for the Canterbury/Westland region is unsurprising, it is also important to note that the flow on effects of the earthquake extend to other areas of the South Island, with the Otago/Southland region also being negatively affected. Respondent comments from the deep south confirm that the earthquake has been the largest inhibitor on activity, with new business/orders and activity drying up.

“The newly established BNZ – BusinessNZ Performance of Composite Index (PCI), which combines the results of both the PSI and PMI, also reinforces the fact that despite the significant drop in activity in the South Island, the relative healthy level of activity in the North Island is keeping the index in positive territory for now.

BNZ senior economist Craig Ebert said that just like the PMI, the PSI showed a dent in the southern region post-earthquake, but was able to narrowly miss dipping into negative territory thanks to it being healthy enough beforehand.

“Industry-wise, despite dips in expected areas post-quake – such as retail and accommodation, the overall employment index has improved since last year. This, combined with similar results in the PMI and other surveys, suggests New Zealand’s unemployment rate is not blowing out as some had feared.”

Both the Northern (54.6) and Central (57.5) regions continued to show relatively healthy levels of expansion, with the later recording its highest value since March 2010. In contrast, both the Canterbury/Westland (39.5) and Otago/Southland (39.5) regions experienced a significant dive in activity, with the former recording its first sub-40 result.

Click here to view the March PSI & PCI

Click here to view the PSI time series data

Click here to view the PCI time series data

For media comment:

Phil O’Reilly 04 4966552 or Craig Ebert 04 4746799