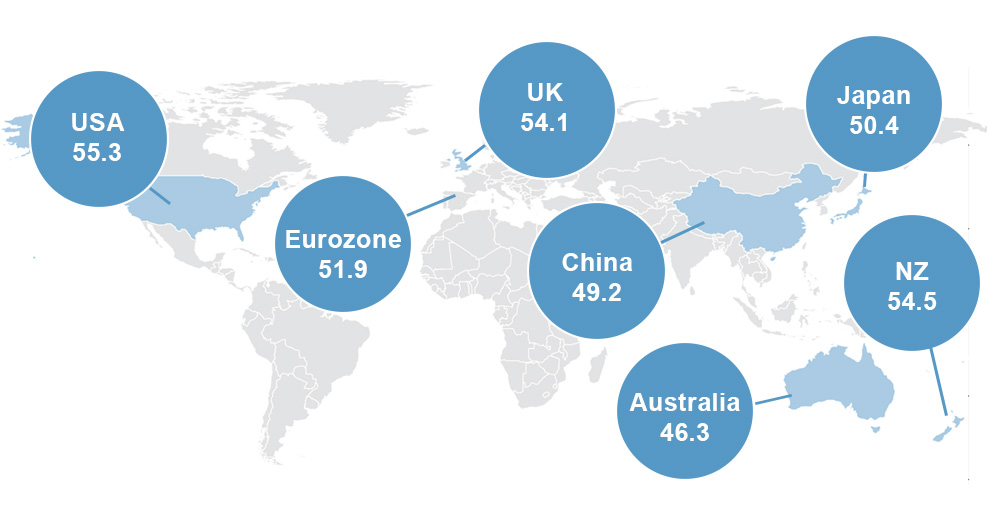

July saw ongoing durability in New Zealand’s manufacturing sector, partly aided by our trans-Tasman cousins according to the latest BNZ – BusinessNZ Performance of Manufacturing Index (PMI).

The seasonally adjusted PMI for July was 53.2 (a PMI reading above 50.0 indicates that manufacturing is generally expanding; below 50.0 that it is declining). Although this was down slightly on the June result of 54.3, combined the last quarter of results represent the strongest level of expansion since early-mid 2010.

BusinessNZ’s executive director for manufacturing Catherine Beard said that the exchange rate story for New Zealand’s manufacturing exporters involves a few angles that need to be considered.

“There is no doubting that negative comments describing the overall value of the New Zealand dollar have increased from June as more manufacturers experience tighter competition for the exporting dollar. However, Australia remains a suitable destination for New Zealand exports given the ongoing competitive exchange rate by historical standards. We also need to throw in recent global economic turbulence which has seen the New Zealand dollar drop back on various currencies. How that plays out in terms of increased orders remains to be seen given jitters in the markets may also have an adverse effect on demand”.

BNZ economist Doug Steel said that attention was on world financial market volatility at present, but we should not lose sight of the strong momentum in the New Zealand economy at present.

“July’s PMI signals ongoing expansion in the manufacturing sector and is positive for domestic economic growth. This is important momentum to confirm, especially in the event that the latest world financial market wobbles dent confidence as it well might. The NZ economy has a decent amount of momentum to carry it through at least some short term nervousness in world financial markets.”

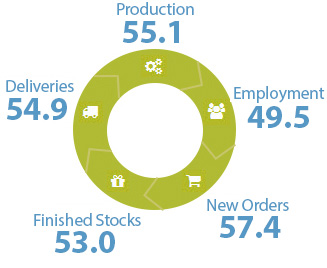

Despite the slight dip in expansion, all five seasonally adjusted main diffusion indices were in expansion during July. Encouragingly, new orders (56.0) led the way for the second consecutive month, followed by deliveries (53.7) and employment (52.2) which reached its highest result since March 2011. Production (51.8) slipped 0.6 points from June, while finished stocks (50.7) went back into expansion for the first time since April 2011.

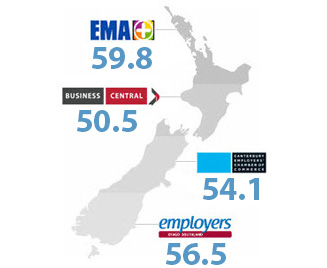

Unadjusted results by region showed three of the four main regions again in expansion, with the Canterbury/Westland region (56.3) leading the way after recovering from its dip in June. Both the Northern (53.3) and Central (50.8) regions fell back from June, while the Otago/Southland region (48.5) reached its highest value since January 2011.

Click here to view the July PMI

Click here to view the PMI time series data

For media comment:

Catherine Beard 04 496 6560 or 027 463 3212

Doug Steel 04 474 6923