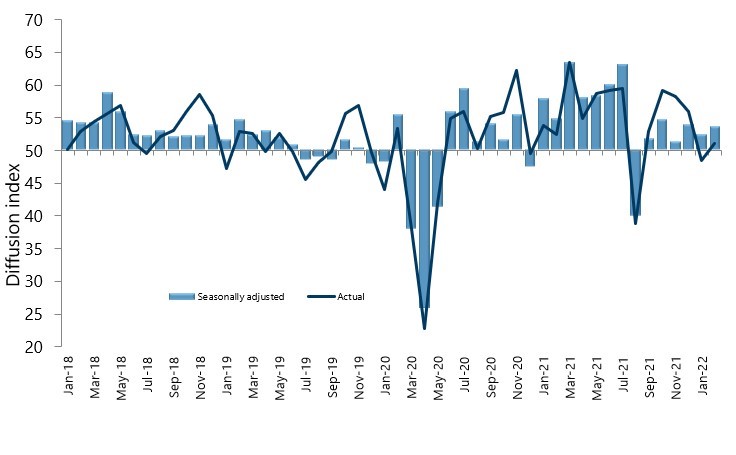

New Zealand’s manufacturing sector saw a lift in the level of expansion for February, according to the latest BNZ – BusinessNZ Performance of Manufacturing Index (PMI).

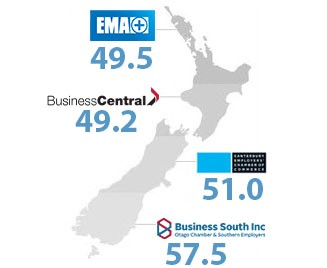

The seasonally adjusted PMI for February was 53.6 (a PMI reading above 50.0 indicates that manufacturing is generally expanding; below 50.0 that it is declining). This was 1.3 points higher than January, and above the long-term average of 53.1 for the survey.

BusinessNZ’s Director, Advocacy Catherine Beard said that there were certainly some positive signs with the February result. However, this needed to be balanced with the wider spread of Omicron potentially affecting business plans in the months ahead, as well as comments from manufacturers still firmly in negative territory (69.9%).

“In terms of the main sub-indices, New Orders (58.2) increased to its highest level since July 2021, while Production (52.1) did experience a slight improvement, although still at its second lowest value since September 2021. Employment (51.7) rose back into expansion, while Finished Stocks (50.0) dropped to its lowest result since November 2021.”

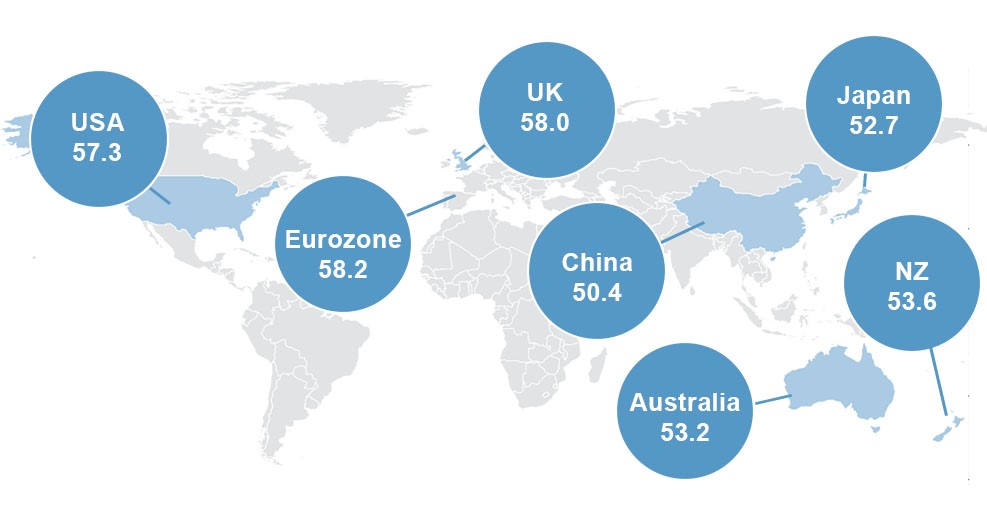

BNZ Senior Economist, Craig Ebert stated that “underlying unease will certainly be piqued by the sustained high COVID case numbers as we go into March. The next PMI result may also see fallout from the Russia/Ukraine conflict, whose global impacts will be felt far and wide.”