Manufacturing activity ended the year on a positive note, with expansion small but steady, according to the BNZ – BusinessNZ Performance of Manufacturing Index (PMI).

The seasonally adjusted PMI for December stood at 52.9. This was up 1.0 point from November, and meant the last four months of the year were positive after 16 months in decline.

A PMI reading above 50.0 indicates that manufacturing is generally expanding; below 50.0 that it is declining. PMI values for December in the years 2002-2008 ranged from 42.2-58.9, with an average score for the previous December results of 52.6.

BusinessNZ Chief Executive Phil O’Reilly said that 2009 came close to representing a tale of two sides when comparing the first to the second half of the year.

“The first half of 2009 continued on from 2008, which was the worst year since the survey began. However, the next six months have certainly shown a trend towards moving out of decline and recovering some lost ground in the sector.

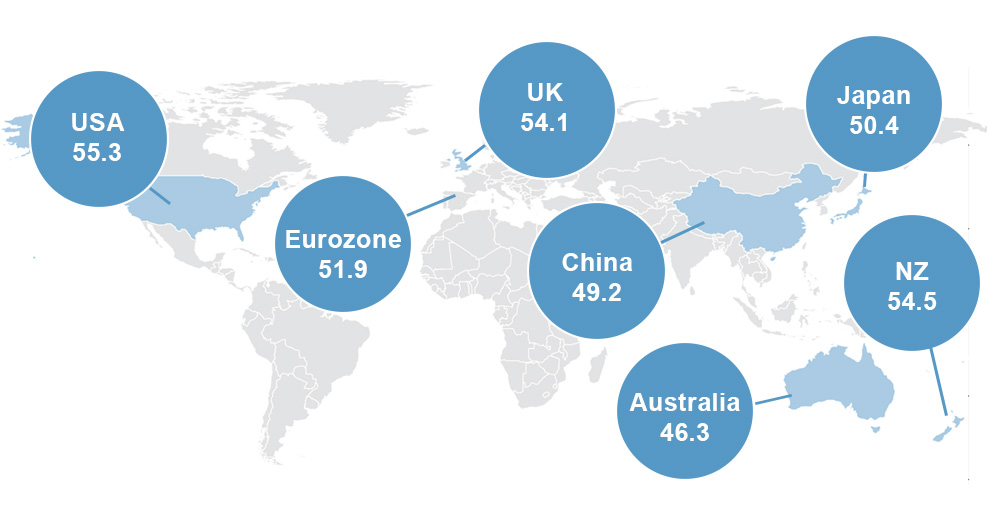

“The level of expansion is still fragile, with future expansion in 2010 partly dependent on the direction of the New Zealand dollar. Australia remains an important customer base, and with the lucky country fairing better than most during the recession, increased comments from respondents regarding further demand from our Trans-Tasman neighbours may help pull activity up to levels more consistent with 2006/07.

Bank of New Zealand senior economist Craig Ebert said the PMI gelled very well with the manufacturing section of the latest Quarterly Survey of Business Opinion (QSBO) published last week.

“The relatively positive picture painted by the PMI was also reflected in the QSBO’s results, with several parallels being drawn. These included similar expectations for the next few months in terms of an increased production and new orders, a relatively lean inventory, an abatement of overdue-debtor problems, and generally more positive cash-flow and profitability.

“So overall, while there’s a lot to recover from, there are some positive steps in the right direction across the board. What we need now is for this to continue.”

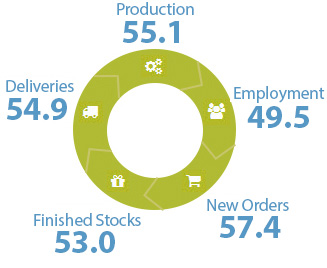

Three of the five seasonally adjusted main diffusion indices displayed expansion. Both production (54.1) and new orders (57.2) both displayed their highest results since November 2007. Employment (48.7) remained in contraction, while finished stocks (47.5) reverted back to a level similar to October. Deliveries of raw materials (52.9) continued to expand with its highest result since February 2008.

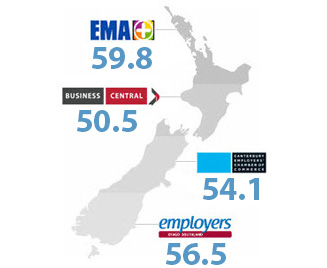

Unadjusted activity for December showed the fourth consecutive expansion for all regions, although all were down from the traditionally strong November period leading into Xmas. Interestingly, the difference in expansion between all the regions was very small. The Northern region (52.6) recorded the strongest level of expansion, followed by both the Canterbury/Westland and Otago/Southland regions at 52.2. The Central region (51.7) recorded the smallest gain over the month.

Click here to view the December PMI

Click here to view the PMI time series data

For media comment: Stephanie Moakes, ph 04 496 6554 or 021 959 831

or Craig Ebert, ph 04 474 6799