Manufacturing activity showed expansion for the third consecutive month, providing a solid if unspectacular end to 2009, according to the BNZ Capital – BusinessNZ Performance of Manufacturing Index (PMI).

The seasonally adjusted PMI for November stood at 51.8. This was up 1.3 points from October, and the first time since late 2007/early 2008 there was expansion in the sector for three consecutive months.

A PMI reading above 50.0 indicates that manufacturing is generally expanding; below 50.0 that it is declining. PMI values for November in the years 2002-2008 ranged from 34.9-57.7, with an average score for the previous October results of 51.5.

BusinessNZ Chief Executive Phil O’Reilly said that while results over the last three months have not shown activity kicking ahead in terms of stronger expansion, we only have to go back exactly a year today to see how much the sector has improved.

“November 2008 saw activity dive bomb to its lowest point of 34.9 since the survey began – a whopping 16.9 points lower than the latest result. The values for the sub-indexes were also terrible, and negative comments completely dominated at over 68% of all comments. Undoubtedly, these were tough times for manufacturers. Since then, the improvement over 2009 has been gradual, culminating in better new orders results during the second half of the year and subsequently improving production figures. However, we still have to remember that while improvement has taken place, there is still a long way to go before the sector completely recovers the losses experienced over 2008 and 2009.”

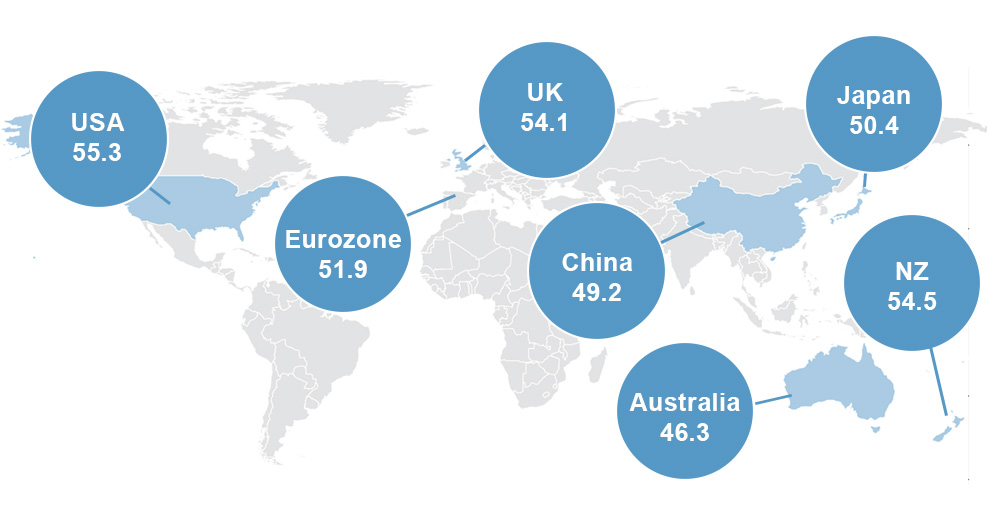

BNZ Capital economist Mark Walton said that while the manufacturing sector has had its fair share of woes during the recession, things are starting to look better as the PMI has now managed to stay above 50 since September.

“It’s hardly a surge, but it does suggest some stabilisation is underway. It’s a theme that’s reiterated in September quarter’s Economic Survey of Manufacturing (ESM), published by Statistics New Zealand earlier this week.”

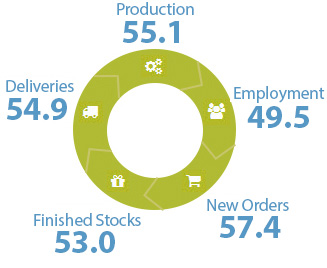

Four of the five seasonally adjusted main diffusion indices displayed expansion. Production (52.8) continued to build on previous results, while new orders (56.0) reverted back to the September result after a dip in October. Employment (50.1) remained largely unchanged during November after contraction during the previous month. Deliveries of raw materials (50.2) was also close to no change during November, while finished stocks (46.6) was the only sub-index that fell from its October result, and the only one in which to show contraction.

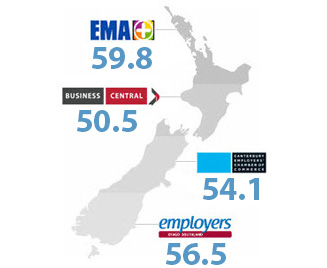

Unadjusted activity for November showed the third consecutive expansion for all regions, with some recording levels of expansion not seen in some time. The Northern region (62.9) experienced a strong increase in activity for November, with its highest result since November 2006. Both the Otago/Southland (61.9) and Central (58.9) regions posted their highest level of expansion since November 2007, while the Canterbury/Westland region (54.4) remained largely unchanged from the previous month.

Click here to view the November PMI

Click here to view the PMI time series data

For media comment: Phil O’Reilly ph 04 4966552, Stephanie Moakes, ph 04 496 6554 or Mark Walton ph 474 6923