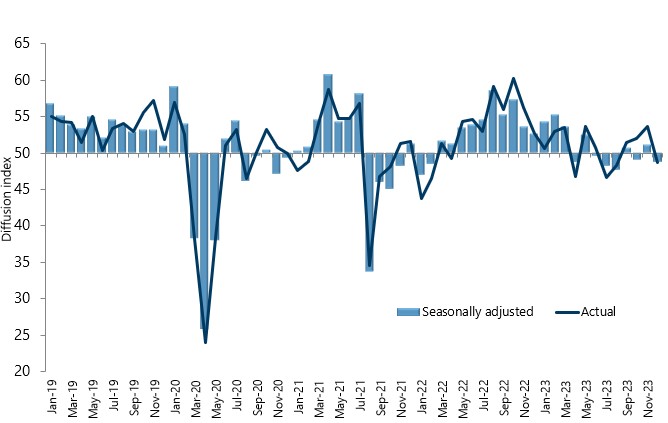

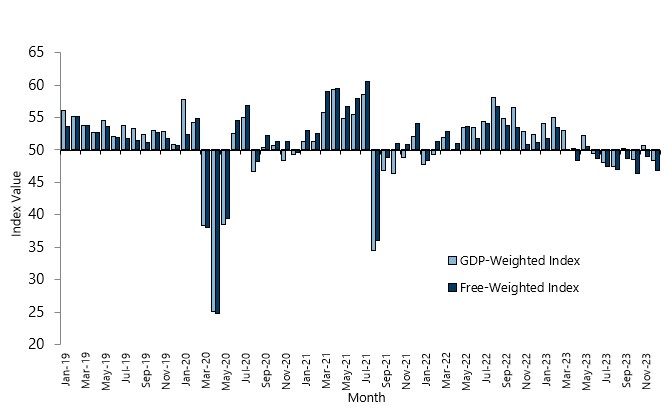

New Zealand’s services sector fell back into contraction during December, according to the BNZ – BusinessNZ Performance of Services Index (PSI).

The PSI for December was 48.8 (A PSI reading above 50.0 indicates that the service sector is generally expanding; below 50.0 that it is declining). This was down 2.3 points from November, and well below the long-term average of 53.4 for the survey.

BusinessNZ chief executive Kirk Hope said that like its sister survey, the PSI has struggled over 2023 with the second half of the year averaging 49.3. While New Orders/Business (51.2) remained in expansion, Activity/Sales (47.1) has remained entrenched in contraction for the last three months. Employment (47.5) recorded its lowest result since February 2022.

“The proportion of negative comments stood at 58.7% for December, which was up from 54.0% for November and 58.2% in October. Overall, negative comments centered on seasonal factors, cost of living and an overall economic slowdown”.

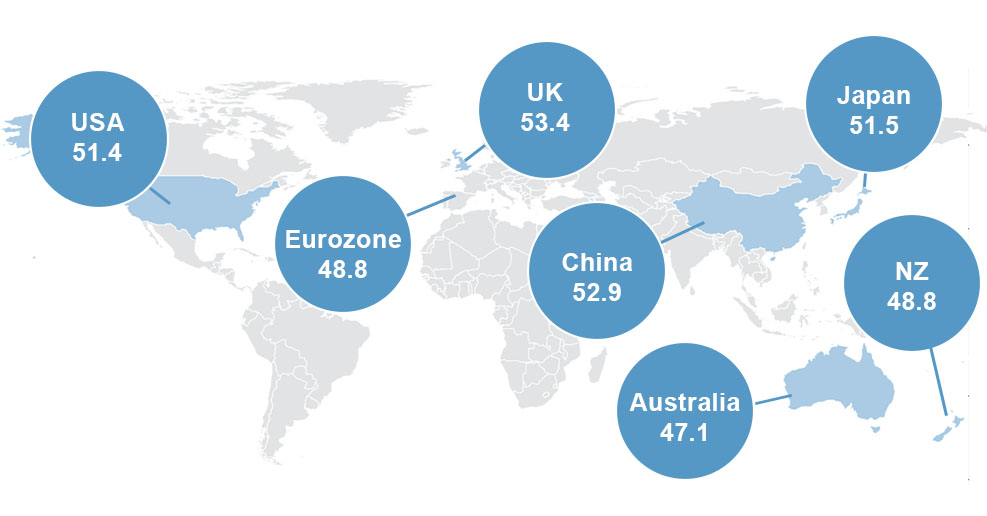

BNZ Head of Research Stephen Toplis said that “the softening in the PSI, alongside the weakness in the PMI, is bad news for both near term growth and employment in New Zealand. Tourism has been a key driver of the services sector and will continue to support the economy, but it can’t do all the heavy-lifting by itself”.