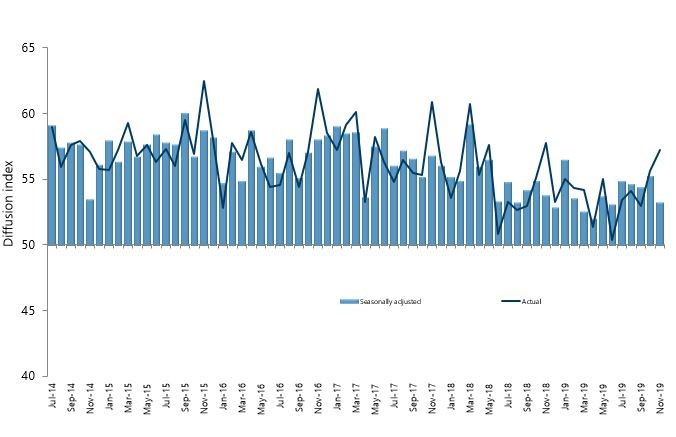

New Zealand’s services sector experienced a dip in expansion levels during November, according to the BNZ – BusinessNZ Performance of Services Index (PSI).

The PSI for November was 53.3, which was 2 points down from October (A PSI reading above 50.0 indicates that the service sector is generally expanding; below 50.0 that it is declining). The November result was also below the long term average of 54.4 for the survey.

BusinessNZ chief executive Kirk Hope said that despite the improvement in October, the November result was the lowest level of expansion since June

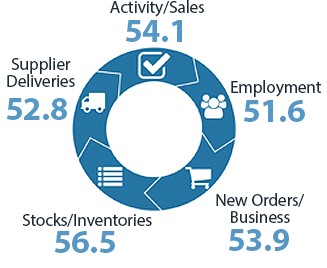

“Looking at the key sub-index values, a key concern is the drop in expansion for new orders/business (53.9), which is at its lowest level since September 2012. The other key sub-index of activity/sales (54.1) also fell to its lowest point since April 2019. These results tend to suggest it may be a while longer before we see a sustained level of healthy expansion for the sector.

Looking at comments from respondents, it was good to see a further lift in the proportion of positive comments that went from 50.7% in October to 60.9% in November.

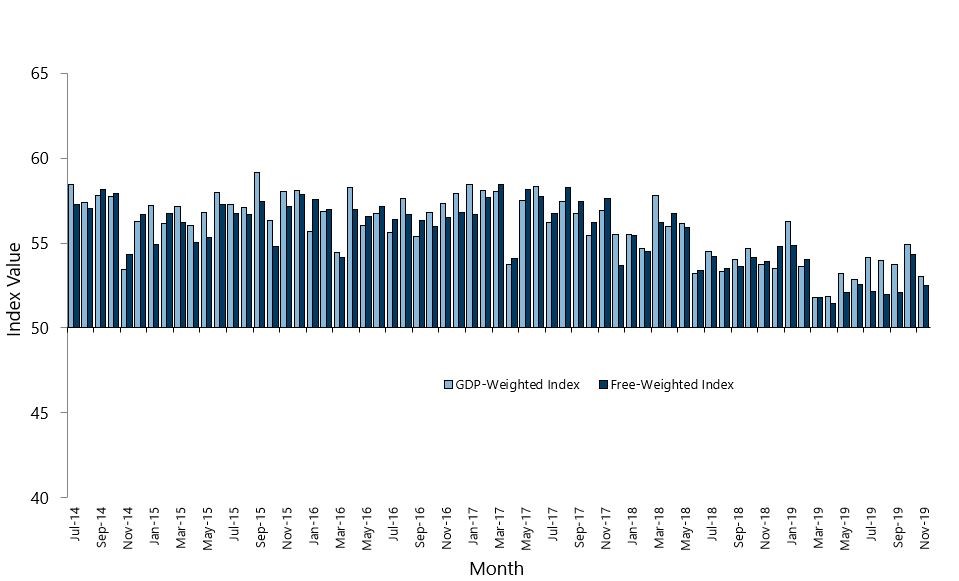

BNZ Senior Economist Craig Ebert said that “the dip in the PSI in November coincided with a slight fall in the Performance of Manufacturing Index (PMI) in the month. Together, these tugged on the reins of GDP growth expectations”.