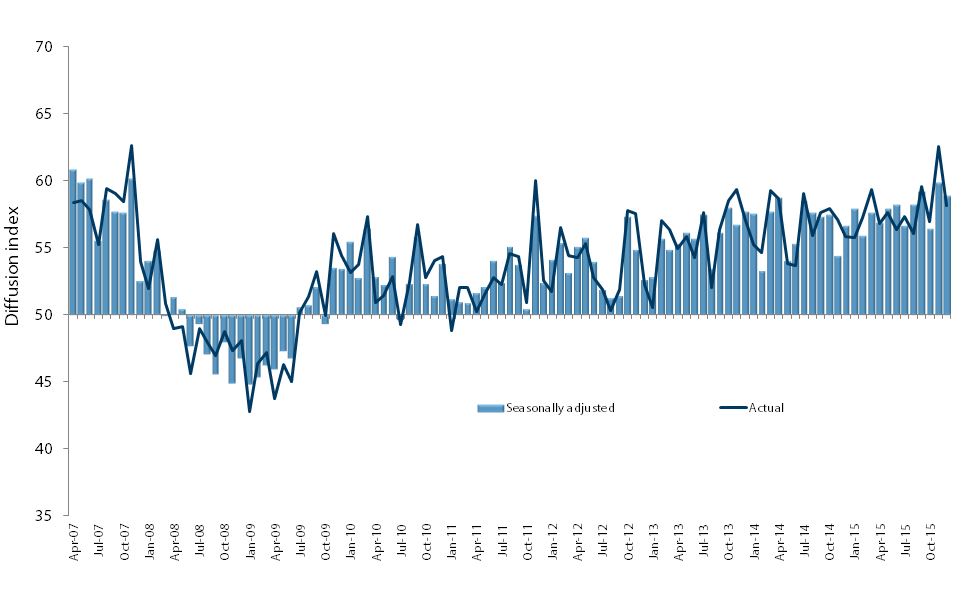

A drop in expansion meant the service sector only just managed to keep on the positive side, according to the BNZ – BusinessNZ Performance of Services Index (PSI).

The PSI for October was 50.6. This was down 2.3 points from 52.9 in September, and 3.0 points down from 53.6 in August. A PSI reading above 50.0 indicates that the service sector is generally expanding; below 50.0 that it is declining. The average PSI value for 2009 was 48.8, while for 2010 it was 53.2. So far for 2011, it is 52.4.

BusinessNZ chief executive Phil O’Reilly said that both the balance and detail of comments from businesses illustrated the fine line the service sector was on at present.

“Comments were slightly more on the negative (51.1%) than positive (48.9%) side for October, while activity from the Rugby World Cup was probably more on the negative than positive side as consumer dollars headed in that direction as opposed to other sectors of the economy, he said.

“Looking at regional differences, a decline in activity for the Northern region to its lowest level since 2009 matches a similar result for the October PMI. Given its relative weight to the economy, any upturn in national activity to finish the year on a positive note will need to see the Northern region reversing current trends.

The BNZ – BusinessNZ Performance of Composite Index (PCI), which combines the results of both the PSI and PMI, shows a contrast in the two options for measuring the PCI for only the third time (50.0 and 48.4). It was also the first time that either measure had shown a decline since June 2009.

BNZ Head of Research Stephen Toplis said the drop in the PSI is yet another sign that the New Zealand economy is struggling at the moment.

“There is nothing like uncertainty to batter business confidence and things don’t get much more uncertain than they are now.

“Amongst other things business confidence is being undermined by: the confusion created by the chaos in Europe; further postponement to the expected pick up in construction activity; weak domestic demand in Australia; the post Rugby World Cup hangover; the first signs that commodity prices might fall in a meaningful way; the General Election and the fall-out from PSA in the Bay of Plenty. Perhaps the remarkable thing about recent confidence readings is that they are as strong as they are.”

Despite the drop in overall expansion, four of the five sub-indices still remained in expansion during October, although only just. New orders/business (54.1) continued to lead the way, although dropping 1.5 points from September. Activity/sales (50.4) remained close to its September result, while supplier deliveries and stocks/inventories (both at 50.1) recorded the minimal amount to show expansion. Interestingly, supplier deliveries was the only sub-index to improve. Employment (49.5) fell back into contraction after an upwards jump in September.

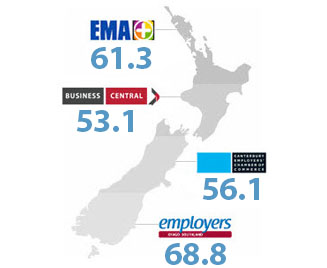

Activity was expansionary for two of the four main regions. While the Canterbury/Westland region (64.2) again lead the way with a strong result, comments from respondents outline subsequent earthquake related work being the main driver for boosting activity. The Central region (54.5) dipped in expansion, although the October result represented its ninth consecutive month of expansion. Like its sister survey the PMI, the Northern region (48.6) also saw contraction in the PSI, while the Otago/Southland region (43.7) showed some improvement from the previous two months, yet still lags behind by a considerable margin.

Click here to view the October PSI & PCI

Click here to view the PSI time series data

Click here to view the PCI time series data

For media comment: Stephen Toplis 04 474 6905