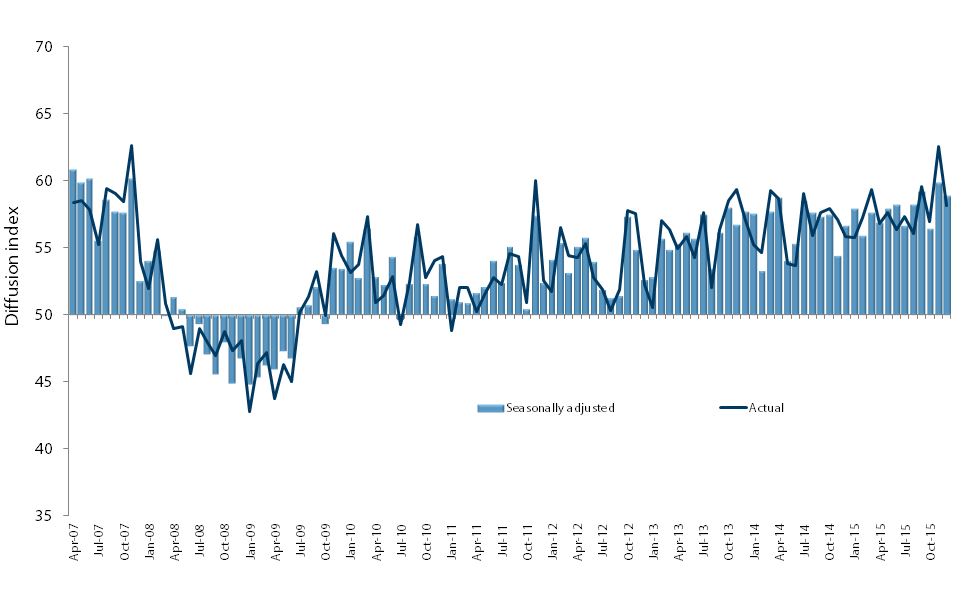

The level of expansion in the service sector for September remained near its peak, according to the BusinessNZ Performance of Services Index (PSI).

The PSI for September stood at 59.0, which was very similar to the top result of 59.4 recorded in August. A PSI reading above 50.0 indicates that the service sector is generally expanding; below 50.0 that it is declining. The survey has now been running for six months, with an average score of 58.0.

All five diffusion indices that make up the PSI continued to show expansion in September. New orders/business (65.4) again led the way, with a level of strong expansion that was exactly the same as August. The level of expansion for activity/sales (60.7) dipped slightly, but stocks/inventories (57.1) experienced a large increase from August, probably due to businesses building up stocks for Christmas.

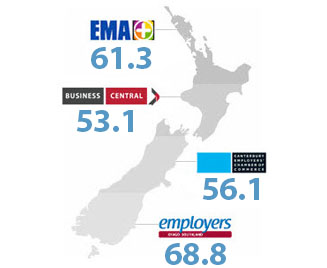

Activity was typically stronger in the South Island, with the Otago/Southland (61.9) and Canterbury/Westland (61.2) regions showing strong expansion. The Northern (58.7) and Central (56.2) regions displayed lower levels of expansion, although well into positive territory.

Most service sectors again showed expansion during September, with wholesale trade (63.4) continuing to dominate. Property & business services (62.3) experienced a pick up in activity after a few months of sliding results, while accommodation, cafes & restaurants (58.1) also received a lift after a lean period of activity.

There was a noticeable pick up in the number of positive comments for September (56.7% positive compared with 43.3% negative). Activity for those with negative comments for September remained at a score of 3.2 (where 1=large rise and 5=large fall), compared with 2.3 for those enjoying positive activity. Overall, the national result for activity compared with 2006, stood at 2.7.

BusinessNZ chief executive Phil O’Reilly said the strong September result, on the back of the August peak, bodes well for the industry leading into the last quarter of 2007.

“Businesses are already gearing up for the busy Christmas season with stocks/inventories showing a sharp increase. It was also pleasing to see a pick up in positive comments as many respondents prepare for what is traditionally their busiest season of the year,” he said.

Click here to view the September PSI & PCI

Click here to view the PSI time series data

Click here to view the PCI time series data