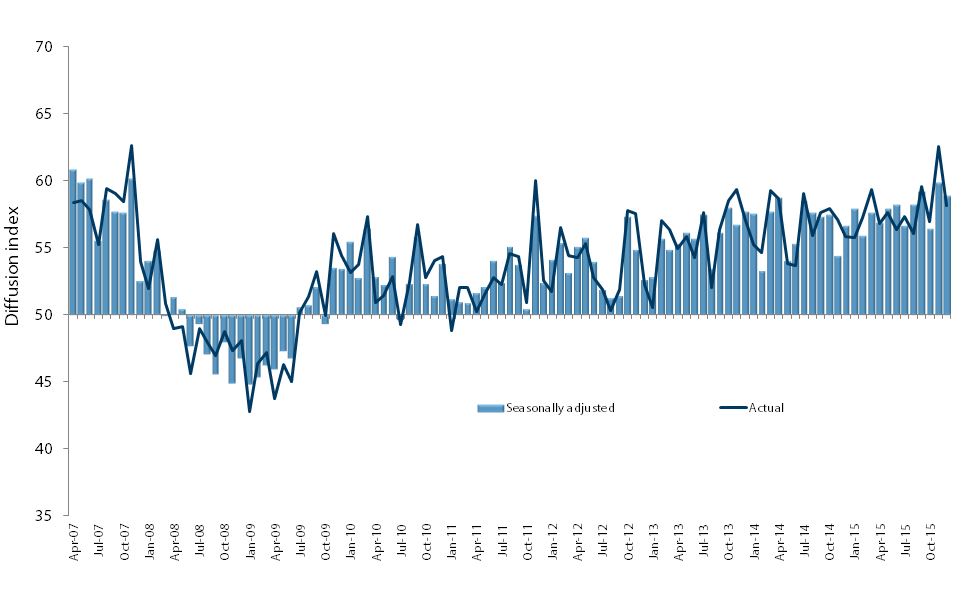

The service sector took a turn for the worse in April, according to the BNZ Capital – BusinessNZ Performance of Services Index (PSI).

The PSI for April was 43.7, down 3.4 points from March, ending a run of relatively improving results for the sector. The April result was also 5.2 points down from April 2008, and 14.6 down from 2007. A PSI reading above 50.0 indicates that the service sector is generally expanding; below 50.0 that it is declining. The average PSI value for 2007 was 58.1, while for 2008 it was 49.1.

BusinessNZ chief executive Phil O’Reilly said that it was disappointing to see the sector re-trench after some relatively encouraging results in February and March.

“The sector has now been in contraction for more than a year, with activity/sales struggling to get a foothold to recover. Despite employment falling back further, it is at least encouraging to see new orders/business not falling to the extent most of the other main indicators have. Nervousness in the market is still holding many back from spending, but there is still a significant group that are finding positive trading conditions over recent months, with many citing new contracts and sales keeping their business busy.

“If we look at off-shore developments, the downturn in the global service sector eased further, but still some distance from outright recovery. Interestingly, the slow global improvement is now at almost the identical level as New Zealand’s April result. This shows that New Zealand’s service sector has managed so far to weather the storm better than most.

Head of Research at BNZ Capital Stephen Toplis says troubled tourism sector is having a major influence on service sector performance.

“Tourism’s success, or otherwise, is split between the revenue it accrues from domestic expenditure in addition to its offshore sourced earnings. In the current environment both are under threat.

“While in theory, with less money to go around, Kiwis should be more likely to holiday at home, this may not be the case as extremely cheap deals are being offered for international travel, particularly to Australia.

“The international situation is even more problematic. The decision to travel to New Zealand is influenced by the well-being of folk in their own economies. This is where things get very ugly indeed. Based on GDP growth, we calculate tourism-weighted activity to contract by 1.7% in 2009 and 1.8% in 2010. The silver lining is that 41% of our tourists come from Australia. The economy there is faring much better than most, and the Australians too are looking for cheaper holidays closer to home.”

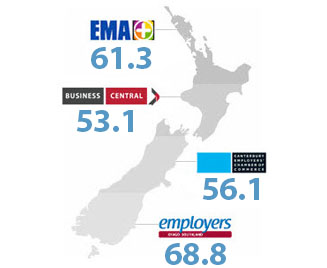

Activity was negative in all four main regions monitored in April. The Northern region (42.8) recorded its lowest result since January this year, while the Central region (48.8) experienced a small deterioration in activity. The Canterbury/Westland region (43.1) reverted back to negative territory with its lowest ever result, while the Otago/Southland region (44.8) improved somewhat after a significant fall in March.

Results for the various service sectors were almost all negative for April. Wholesale trade (39.3) experienced a significant fall in April, dropping to its lowest ever result. Retail trade (44.6) continued to recover (albeit slowly), while accommodation, cafes & restaurants (43.4) also experienced a modest recovery. Health & community services (51.1) continued its run of positive results for 2009, and the only service sector to show expansion for the month.

Click here to view the April PSI & PCI

Click here to view the PSI time series data

Click here to view the PCI time series data

For media comment:

Stephen Toplis, ph 04 474 6905