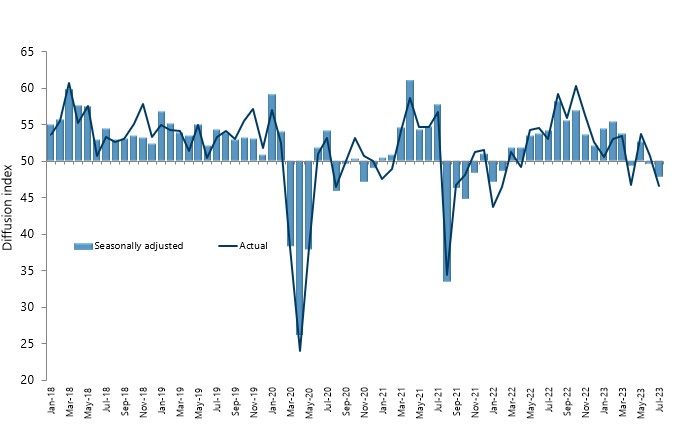

New Zealand’s services sector experienced further contraction during July, according to the BNZ – BusinessNZ Performance of Services Index (PSI).

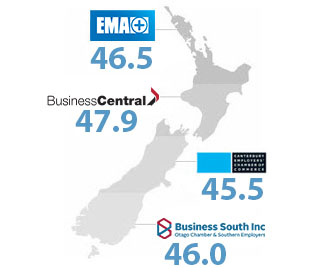

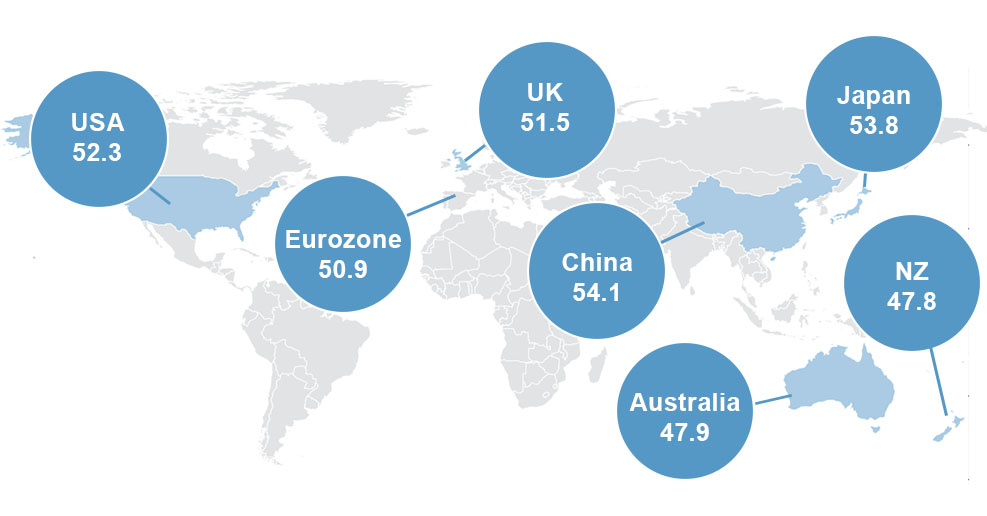

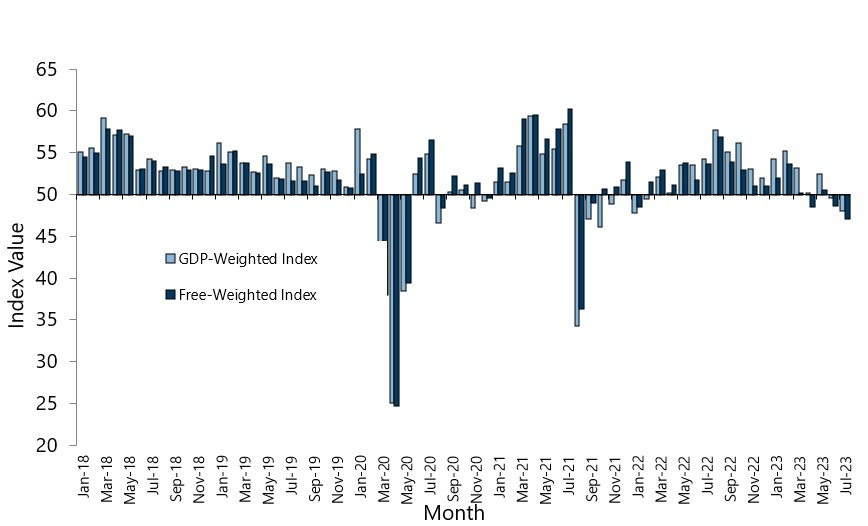

The PSI for July was 47.8 (A PSI reading above 50.0 indicates that the service sector is generally expanding; below 50.0 that it is declining). This was down 1.8 points from June, and the lowest level of activity for the sector since January 2022. It was also well below the long-term average of 53.5 for the survey.

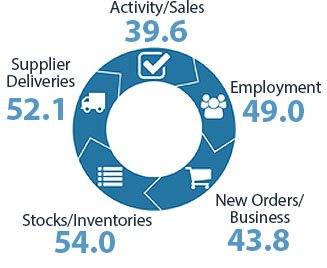

BusinessNZ chief executive Kirk Hope said that there were a few key concerns with the July result. While not all of the five main sub index measures were in contraction, the two key indicators of Activity/Sales (39.6) and New Orders/Business (43.8) experienced a sharp decline, with the former at its lowest point since August 2021 when the country last experienced a lock-down. In fact, it is the lowest result for Activity/Sales that was not lock-down related since the survey began in 2007.

“The further fall into contraction during July also saw another lift in the proportion of negative comments, which rose to 67%, compared with 55.6% in June and 49.4% in May. Overall, negative comments received were strongly dominated by a general downturn in the economic conditions/slowing economy, as well as ongoing increased costs”.

BNZ Senior Economist Doug Steel said that “the results all point to a sharp drop in demand in July, significantly accelerating the slowing trend that had been evident for many months”.